P2P Lending in India

In today’s modern, and rapidly evolving era, we all need a smooth, unruffled solution in each aspect. P2P Lending is the example of that ultimate leading solution in borrowing money through numerous internet platforms. P2P lending was first introduced to the world by United Kingdom via a platform by the name Zopa. However, in India it started in the year 2012. Although, this industry is at a nascent stage, but it has a lot of potential to grow, as Indian investors are looking to park their money for better returns.

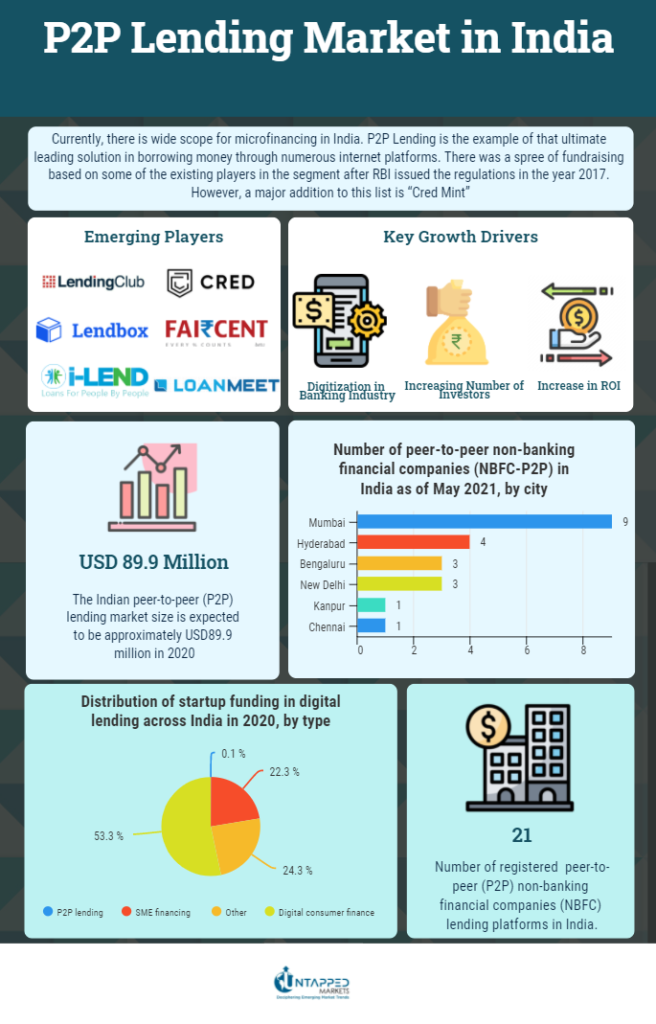

P2P Lending’s rapid growth can be witnessed nationally in terms of both numbers and volume of players. As of 2021, the Indian market had 21 P2P lending players. This segment will help small businesses meet the capital requirement by acting as a additional source of funding

Major Players in the Segment

There was a spree of fundraising based on some of the existing players in the segment after RBI issued the regulations in the year 2017. Faircent was India’s first P2P lending platform to receive an NBFC-P2P license from RBI. There is a list of numerous organizations that are part of this space, i.e. Lendbox, Lendingkart, IndiaMoneyMart, Finzy, and RupeeCircle. However, a major addition to this list is “Cred Mint”. The Bengaluru-based fintech startup recently launched Mint in partnership with Liquiloans, an RBI-registered P2P NBFC. There is an average of INR 2 lakh sitting in Cred members savings accounts. As a part of their mission, they want the individual investors to earn higher returns as compared to traditional assets. However, only members who signed up for early registration have access to Mint.

Growth Drivers and Challenges in P2P Lending

In India, where there are numerous issues regarding financial services – the requirement for formal financing options especially for the underprivileged strata of society has risen significantly over the most recent years, taking into consideration the proliferation of the cell phone, internet and other complimentary services. In addition to the same, the pandemic has become one of the primary reasons for the expansion of online lenders.

Currently, the sector is bifurcated into two parts. Only 4-5 companies in the India P2P lending business have a solid business plan, and the rest are still in the gestation period. As a result, the industry including the investor and companies have not witnessed growth for many years. Moreover, regulatory changes by the RBI have further given a blow to this sector. However, it was not just P2P lending, but the entire lending sector which witnessed a slowdown and now the sector is expected to recover by 2022.

As per a recent report by SBI, the number of individual investors in the Indian market has increased by a whopping 142 lakh in FY21. This shows that the risk appetite of Indian investors is increasing. In such a scenario, P2P lending can be an emerging product in the low-risk arena.

The Role of CRED Mint

The name “CRED ” is a well-established brand in India. By using Cred Mint, they can exploit their current user database to generate an additional stream of revenue. CRED Mint will extend the loans via CRED Cash, its lending product, to community members who already use the app and its services. They have associated with NBFC, Liquiloans and they are planning to collaborate with other leading players in this sector in the upcoming future.

CRED Mint has something special which makes them unique from others. They have kept the criteria of having a credit score of 750 or above to avail this service. With these specific criteria, CRED can get a database of financially secured people who can be targeted for a loan. The model followed by them in this service is “purchase now and pay later”. One is able to invest INR 1 Lakh to 10 Lakh within few seconds, and most importantly, investors can pull back their money with interest too easily within one working day without any forfeiture along with a return of 9% on their investment.

CRED Mint has made the overall service smooth and fluid, with which anyone can borrow and invest money without any difficulties at all. A whopping amount of commission is made by the fintech companies in this industry.

How does it work?

The procedure starts with people registering to the different Lending platforms like Faircent as a lender or borrower. Then the loan can be availed when the borrower applies. The platform identifies the said borrower’s creditworthiness. Then a loan agreement document signed by both parties once the borrower accepts the loan offered by the lender and division of money into units starts from here. It varies and has no fixed value. Borrower pays back in monthly instalments to the lender, and the lender makes an online payment. Finally, the amount as the commission is paid for the provided services by the borrowers and lenders.

The Future of P2P Lending Industry

With better returns and one click investing, these platforms shall continue to expand as an investment alternative for people. P2P Lending has the potential to disrupt the fintech industry. It now allows lenders to earn a better return, permitting borrowers to get a cheaper interest rate and reducing intermediate costs by relying on technology-enabled processes. As long as these lending platforms maintain and develop their lending requirements and improve technology periodically, growth of this industry would continue. The future of the P2P Lending industry seems more progressive in the upcoming years seems more progressive in the upcoming years. An individual can expect greater returns through P2P Lending (as it will be an emerging investment pathway for lenders) as compared to other minimal risk products in the same category and hence it is expected that this segment may reach to a level of mutual funds in next few years.